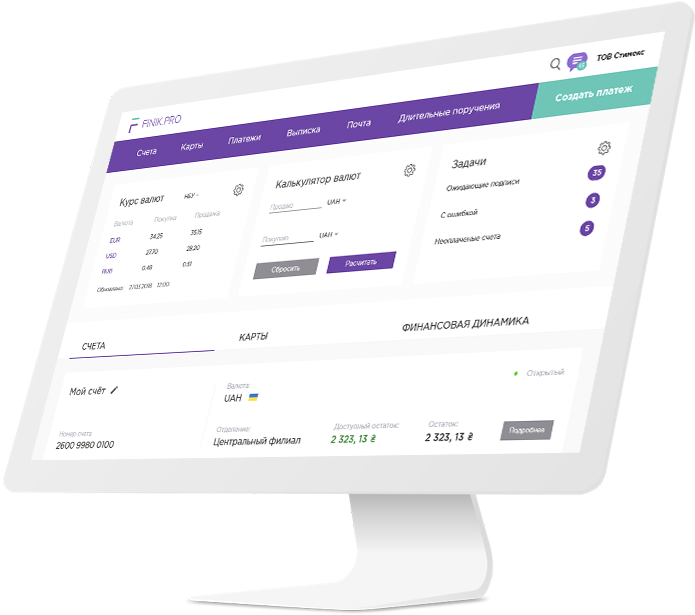

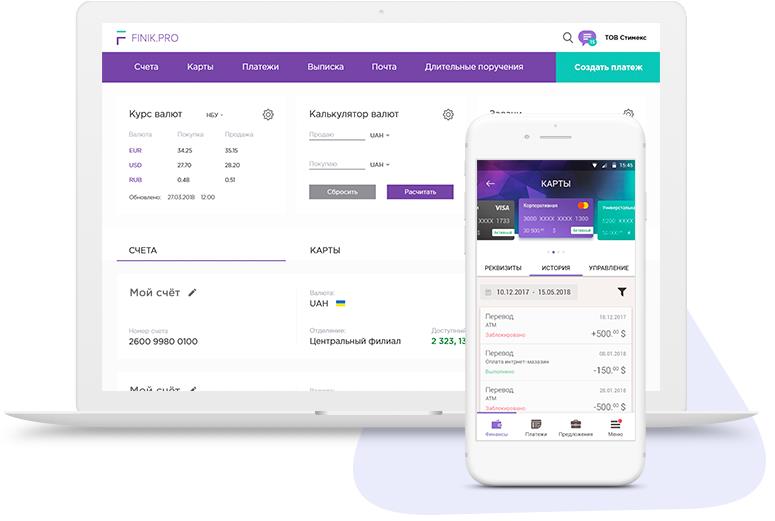

Finik.Pro is a software development company of complex banking and multifunctional fintech solutions.

Products

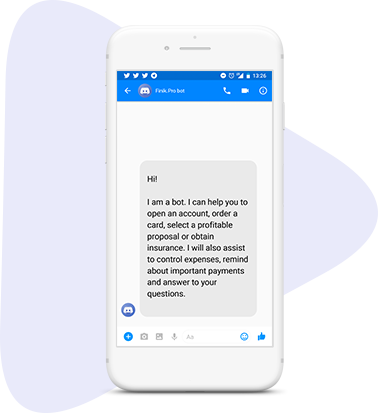

We specialize in developing applications for mobile and online-banking, self-learning chat-bots, banking applications for smartphone, contactless payments based on NFC and QR technologies.

Our mission is to ensure a user-friendly approach in banking services.

The team members combine 20+ years of experience in banking and IT.

Solution added value is a prompt integration with useful business services such as online cash desks, factoring, online accounting, reporting system, electronic documents circulation and many more.